The Logic of China's Financial Opening Policy

Financial services take up an entire chapter in the phase-one trade agreement between China and the United States. That suggests that financial openness played an important role in the bilateral trade negotiations that led to that accord.

Both countries pledged to accelerate bi-directional opening of the financial sector and relaxing access limits,provide fair,effective and nondiscriminatory market access for each other's financial companies in sectors such as banking,credit rating,electronic payments,financial asset management,insurance,securities,fund management,and futures. This is a move that is mutually beneficial and in line with China's objectives. The agreement reflected the progress China has made in actively pushing for an orderly opening-up of the financial sector. Ultimately,that will help the competitiveness and resilience of the Chinese financial system and boost Sino-US cooperation.

This clearly indicates that the effort by some US senators to achieve financial decoupling has gone nowhere,at least for the time being. During the trade war,some Chinese scholars argued that China should play its holdings of US Treasury bonds as a trump card. My view is that China's purchases of US Treasury debt are not only a rational investment,but also a necessary part of global financial cooperation. This argument still holds. After the opening-up of China’s financial services sector,domestic competition could intensify significantly,not only for foreign financial institutions,but for local participants as well. If we compare the situation in China to financial openness elsewhere,it is obvious that China still has room to open its markets further. Continuing to open up and reform while figuring out ways to mitigate potential risks,is also very important.

Accelerating Liberalization

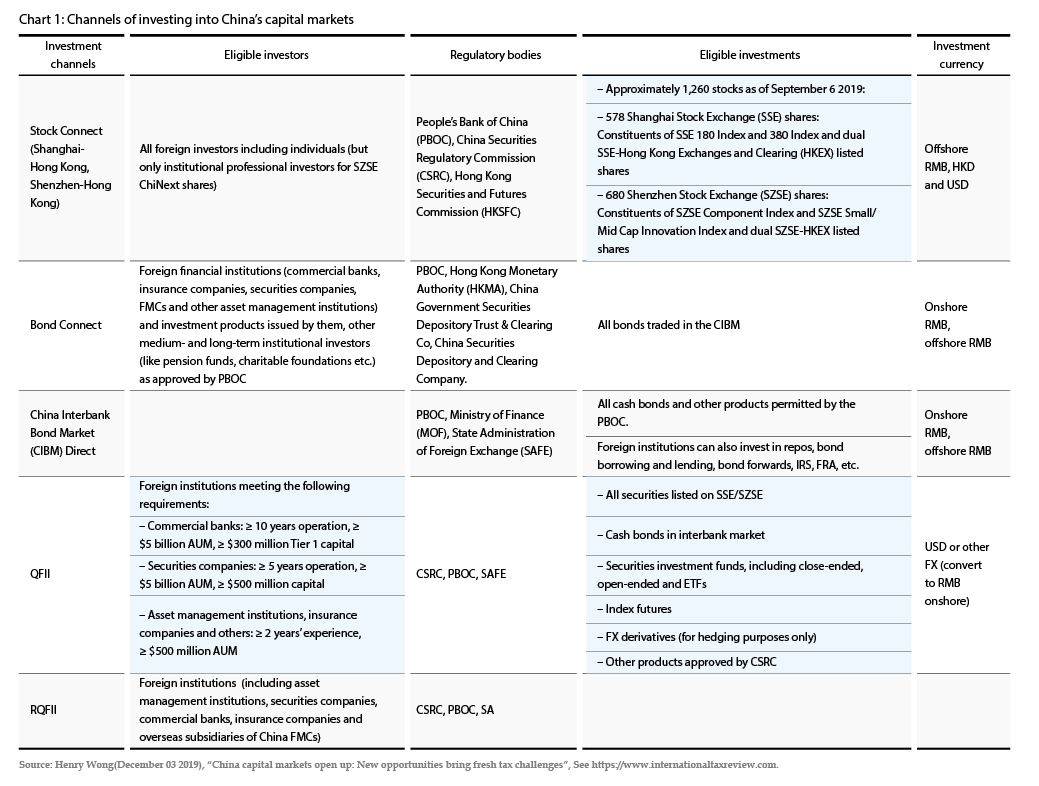

In the past two years,China has significantly opened up its financial sector (See Chart 1) .First,the Boao Forum in April 2018 sent a very strong signal of plans to accelerate the liberalization of the financial sector. Since July of 2019,"11 measures regarding the opening-up" and a series of other substantive policies were released. The pace and determination exceeded many observers' expectations. Although the direction of China's financial reform and opening-up is an established national policy,the prominence of financial services in the China-US economic and trade agreement signed on January 15 this year underscores the importance of this policy objective.

This round of financial liberalization is all-encompassing: from market access to institutional frameworks,from business scope to shareholdings,from banking,securities and insurance to asset management,brokerage and bank cards,from investment to intermediaries.

In the securities industry,restrictions on foreign ownership of securities companies,fund management companies and futures companies will be completely abolished by the end of 2020. The authority will also allow foreign institutions to rate all bonds issued in the interbank market and on exchanges,and allow foreign institutions to obtain a Class A leading underwriting license for the inter-bank bond market.

In the banking sector,the limits on foreign shareholdings in Chinese banks will be abolished in accordance with the principle of equality between domestic and foreign investors. The examination and approval of foreign banks for conducting renminbi business will be abolished,and foreign banks will be allowed to carry out renminbi business upon opening without any waiting period. As of late last year,foreign banks were allowed to conduct business acting as receiving and paying agents.

In the insurance industry,foreign entities will be permitted to own 100% of a life insurance company once a current cap of 51% is scrapped. The transition period has been advanced by one year to 2020 and the requirement of 30 years of operation has been abolished. Foreign ownership of other insurance companies may exceed the existing limit of 25% (and no new ceiling was specified),with foreign equity in pension management companies also permitted.

Other measures include encouraging overseas financial institutions to participate in the establishment and investment of commercial bank financing subsidiaries and allowing overseas asset management institutions to set up foreign-controlled wealth management companies in joint ventures with subsidiaries of Chinese banks or insurance companies. They also permit the establishment of wholly or partly foreign-owned currency brokerage companies,and open up the credit and debit card business,with American Express making a preparatory application to set up a clearing house,Connect Inc.

In terms of investment,the first measure was to remove the quota restrictions on QFII (qualified foreign institutional investors) and RQFII (renminbi qualified foreign institutional investors). Restrictions on RQFII pilot countries and regions were also abandoned. Qualified overseas institutions around the world can use offshore renminbi to carry out domestic securities investment.

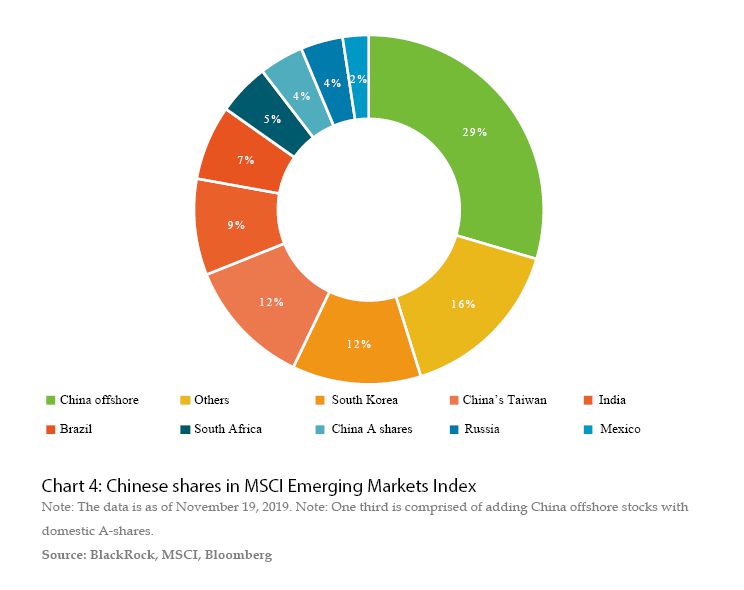

The second is the inclusion of Chinese stocks and bonds in the international index system,where there has been a steady rise in their weightings. In the equity markets,for example,MSCI has added China A-shares to the MSCI emerging markets index and the global benchmark index. As of November 2019,the weighting of A-shares had been increased to 20% as part of a three-step process. FTSE Russell has included A-shares in its global equity index series as of June 2019 and S&P Dow Jones added A-shares to its emerging markets global benchmark index in September 2019.

In the bond market,Bloomberg Barclays added Chinese government bonds and policy bank bonds to its global composite index starting April 1,2019. In September 2019,JPMorgan announced that Chinese government bonds would be included in its index series from February 28,2020. FTSE Russell is likely to release information on whether to include Chinese bonds in its index after an interim review in March 2020.

The IMF's Article 4 consultation report on China,released in August 2019,estimated that inclusion in international indices alone could attract inflows of US$450 billion over the next two to three years.

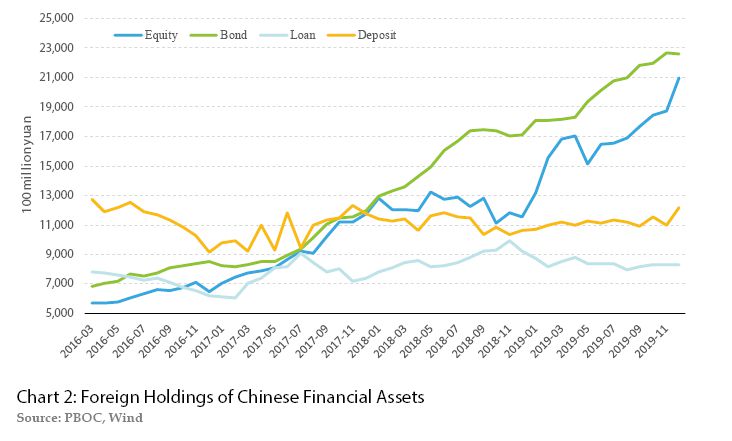

In my opinion,the expansion of financial openness,on the premise of effectively preventing risk,has the effect of promoting financial reform,improving competitiveness,balancing cross-border capital flows and enhancing internal and external confidence (See Chart 2). In addition,according to the assessment of the IMF,China's opening to the outside world has had a significant driving effect on the nation’s economy. In the long run,it may increase GDP by as much as 9.4 percentage points,according to IMF estimates. If commodity tariffs were eliminated,GDP would increase by 3 percentage points while easing restrictions on foreign direct investment would raise GDP by 6 percentage points. If non-tariff barriers to services were lowered,the increase in GDP growth would be 0.4 percentage point.

Financial Decoupling?

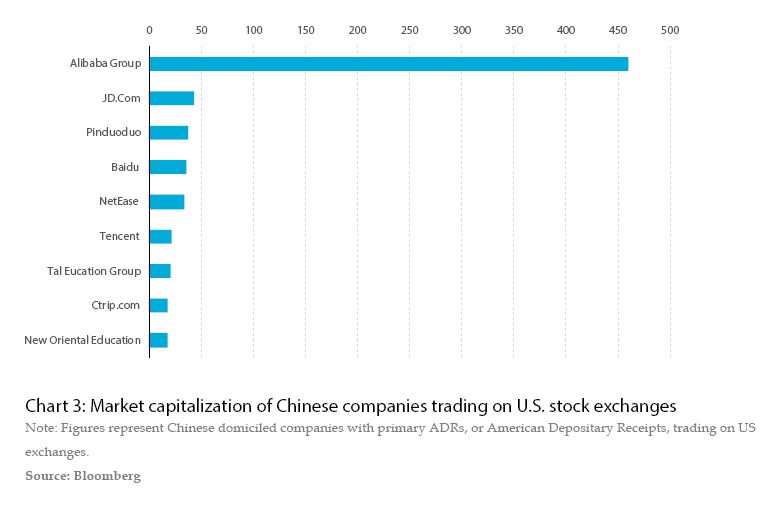

Putting financial content into the phase-one trade deal is also very important in the sense that it helps connect the US and Chinese financial worlds. Since September last year,there have been numerous reports of US officials considering whether to limit US investors’ portfolio flows into China. If that were to be put in place it would have repercussions for billions of dollars of investment pegged to major indexes. The potential options seemed to include limiting Americans’ exposure to the Chinese market through government pension funds,delisting Chinese companies from US stock exchanges (See Chart 3),and putting limits on the Chinese companies included in stock indexes managed by US firms.

Several US senators backed a bill called the Taxpayers and Savers Protection Act which would block a US government retirement fund,overseen by the Federal Thrift Retirement Investment Board (FTRIB),from investing in some Chinese companies after the fund’s board approved plans to transition to a different emerging market index. Chinese stocks would be off-limits to this retirement fund under the bill which was introduced on November 6,2019. The intention of the bill is said to address concerns that such investments would undermine national security and contribute to China's economic and corporate growth. Although the bill has bipartisan support,there's no guarantee that it will be considered by the Senate and brought to the floor for a vote (See Jenny Leonard and Shawn Donnan (September 27,2019),White House Weighs Limits on U.S. Portfolio Flows Into China,www.bloomberg.com.).

The FTRIB has made its position clear. At its November 13 board meeting,it stated that the investments under the new index would be in the best interests of retirement plan participants. The board's decision allows its US$50 billion TSP I Fund to mirror an index that invests in emerging markets,including China. "Investing in emerging markets is not only legal but is the overwhelming choice of fiduciaries across industries and the choice of individual Americans," wrote Michael Kennedy,the FTRIB chairman,in a letter to the senators. "The board is fulfilling its role as fiduciary of a retirement plan."

Chinese shares,including those trading offshore in Hong Kong and the US,now account for more than one-third of the MSCI Emerging Markets Index (See Chart 4).

The fact that financial services are so prominent in the phase-one trade agreement suggests that there is a consensus that decoupling the US and Chinese economies would not be in the interest of either country. Instead,integration and cooperation are the way forward.

Should China Play the US Treasury Bond as a Trump Card?

On the other side of the world,in China,there have been repeated discussions on questions such as whether China could use its US Treasury bond holdings as a card in the high-stakes poker game with the US. The US uses trade and the exchange rate as its cards,why can't China play the Treasury card? What is the best way to employ these US Treasury holdings?

Since 2007,there has been periodic pressure for China to reduce its holdings of US Treasury bonds and further diversify the nation's foreign exchange assets. The voices of those advocating such a move have grown louder at sensitive times for the world’s financial markets. The first such instance was during the US financial crisis,and the public debate continued between 2007 and 2009. During this period there was a sharp devaluation of the US dollar and tremors were felt across the bond market as the US federal government’s huge rescue packages and fiscal deficits required large new issuances of debt. The prospect of further market disruption alarmed President George W. Bush and his Treasury secretary,Hank Paulson,and later,Treasury Secretary Tim Geithner under the Obama administration. Chinese officials made repeated denials of any such plans to reduce their holdings.

The second round of pressure was in 2011. At that time,the European debt crisis was intensifying and political gridlock in the US blocked any increase in the US debt ceiling. Standard & Poor's downgraded the US sovereign credit rating and Bill Gross,often called the US "bond king," announced a short sale of US Treasury bonds. (Gross eventually admitted defeat,vowing never to fight the central bank.)

The latest one stemmed from a report by Bloomberg News on January 10,2018,saying senior Chinese officials had suggested slowing the pace of investment in US Treasury bonds because of their reduced attractiveness. US Treasury bonds were sold off before a SAFE spokesman denied that any such investment determination had been made.

So why did this issue create so much public debate again this time? Because this was another sensitive time for the financial markets. The US government had just passed tax cuts that would generate an additional deficit of more than US$1 trillion over the next 10 years. Meanwhile,a plan to increase infrastructure investment was seen as requiring significant new bond issues amid the lingering shadow of the debt ceiling. With the steady recovery of the global economy,the Fed's rate hikes and balance sheet reductions coupled with tighter monetary policies of other central banks,the bond market had long been uneasy. The US dollar depreciated by 9.7% in 2017,and whether it would reverse the trend was still uncertain. The US was playing a large role in trade with China and the yuan's exchange rate. It had publicly declared China as a strategic opponent. China's every move in the US Treasury debt market would attract attention. No matter whether the news was genuine or not,it was enough to roil the market.

In fact,people are sometimes overly sensitive to how China invests in US government debt. From a professional perspective,how to allocate US Treasuries is part of managing China's foreign exchange reserves investment portfolio. The investment decisions are usually based on exchange rates,interest rates,terms and liquidity. Investments are distributed across different regions and currencies. It is natural and normal for any investor to make adjustments in the operating strategy,especially when the portfolio involves trillions of dollars of foreign exchange reserves. If investment strategies were not dynamic and flexible,it would be surprising. Such changes may take place regularly so they should not be overstated or made to seem like a political decision.

In addition,as the largest and most liquid bond market,the US bond market is an important investment target for trillions of dollars of foreign exchange reserves. Data show that since 2008,the dollar index rose 20.1% and US Treasury bond rose 37.4%,a total of 57.5% and 5.75% per annum on average. As a low-risk asset with liquidity and guaranteed security,this return is generally acceptable.

In early 2018,the US bond market saw modest fluctuations,with 10-year yields increasing by 13 basis points. This was mainly due to internal factors such as economic recovery,tighter monetary policy and higher fiscal deficits,as well as market expectations of the bond market turning bearish. Following Bloomberg's report on January 10,the yield fell 2 basis points. This demonstrates that professional investors have not really taken the Chinese factor seriously,because they do not believe Beijing will reduce holdings of US Treasury debt on a large scale or in an impulsive manner. With the steady recovery of the US economy,the position of the US dollar as a reserve currency will not change in the next few decades and the size and liquidity of the US bond market will remain unparalleled. So why give up US Treasury bonds? Although China holds over a US$1 trillion of US Treasury bonds,it is only a small part of the market.

Therefore,China's purchases of US Treasury debt are not only a rational investment,but also a necessary part of global financial cooperation. China will not easily reduce its holdings of Treasury bonds as the "financial card" against the US,unless it has to. If China and the US can establish a more active and open cooperation mechanism while safeguarding mutual interests,it will benefit both sides.

A Host of Competitive Challenges

After the opening-up of China's financial services,the competition could intensify,not only for foreign financial institutions,but for local participants as well.

Foreign bankers,asset managers,securities firms and insurance companies now have more access to China,and this unfettered entry to China could be one of the main profit drivers for these giants in the future. But no doubt true success may only come if they can compete with local dominant runners.

Citing China's hedge fund market as an example: three years after it was opened to global asset managers,international names like BlackRock Inc.,Man Group Plc,Bridgewater,Fidelity licensed to run Chinese hedge funds,known locally as private securities funds,had only a very small fraction of assets as a group,indicating that it is very hard to win over the country’s investors. Building a brand in China is a challenge,and this limited name recognition is also compounded by distribution hurdles.

In banking sector,though JPMorgan Chase & Co. is one of the best in the world,but Chinese local banks such as ICBC is bigger and more profitable,and also is much more deeply rooted in the local market,thus appears to have huge advantage. Despite this,JPMorgan is fully committed to establishing itself in China,like its CEO Jamie Dimon vowed during a Bloomberg interview,"we're all in." The upcoming intensifying competition between these financial giants could boost the system efficiency over time.

Reform and Risk Mitigation

China's opening of its US$45 trillion financial industry began in earnest over the past two years. As I mentioned earlier,the expansion of financial openness has the effect of promoting financial reform,improving competitiveness,balancing cross-border capital flows,enhancing internal and external confidence and boosting the economic development.

In November 2019,when talking about what has contributed to China's economic growth over the past four decades,Harvard professor and economist Robert Barro gave several reasons,and opening up to the outside world ranked first. Other factors included knowledge diffusion,investment,convergence,and population mobility,he said.

On potential benefits of liberalization,in its report of Article IV consultation with China concluded in July 2019,the IMF believes that China "would benefit from further opening up its service sector and simplifying approval of inward investments." The IMF also mentioned the recent changes to the negative list and the new foreign investment law,saying they are welcome further steps towards "equal market access and treatment of public procurement,and should be implemented consistently across localities."

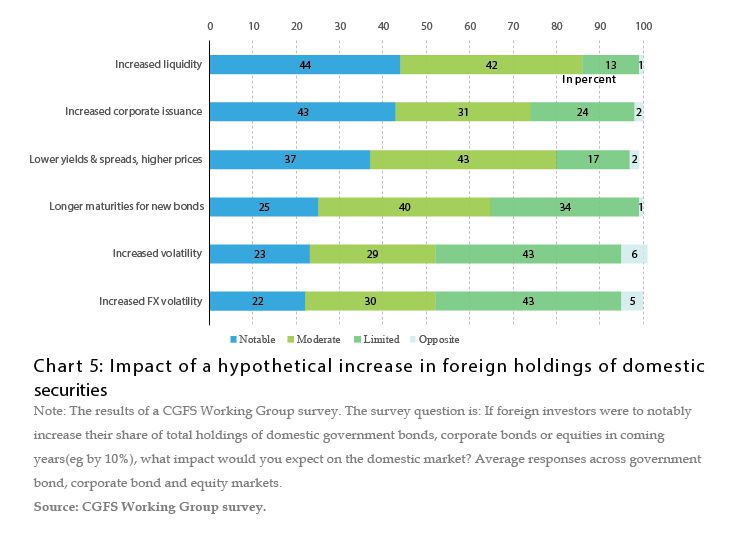

Opening up access can lead to a number of positive effects in jurisdictions' corporate securities markets,according to a January 2019 report Establishing Viable Capital Markets submitted by a Working Group established by the Committee on the Global Financial System(CGFS). The process expands the potential pool of savings,reduces the cost of capital by enabling risk-sharing between domestic and foreign agents. The entry of foreign participants can increase local market liquidity and depth,reduce volatility by lowering sensitivity to country-specific developments,even if it increases exposure to global spillovers. The prospect of foreign participation and competition can also promote the implementation of international best practices and standards(See Chart 5).

For China,the opening is as much a chance to reform as it is an opportunity to address US complaints,right or wrong,about the nation being a one-sided beneficiary of trade.

For example,China's new Foreign Investment Law was passed in March of 2019,and has taken effect in January this year. It lays great emphasis on equal national treatment of foreign investment,addresses many of the core concerns of companies operating in China,including dealing with issues around unequal access to China's market and intellectual property protection,explicitly banning forced technology transfers,protecting foreign investor’s legitimate rights and interests. It pledges greater recourse when intellectual property rights are violated. The law also ensures equal treatment for foreign firms in government procurement,even allows foreign firms to participate in the drafting of standards and government procurement. Now the question lies in the implementation of the updated legislation,which will largely determine if it will really improve the ease of doing business in China.

China's new Securities Law,approved by top legislature in late 2019 and has been effective on March 1 this year,marks another important step to further liberalize and reform China's capital markets. Major changes in the amended law, which includes registration-based other than current approval regulatory IPO regime (replacing the framework),enhanced disclosure requirements and investor protection rules,remind people of U.S. Securities Act of 1933 and the Securities Exchange Act of 1934.

The MSCI has completed the third and final phase of the 20% partial inclusion of China A shares in the MSCI Indexes. As of the close of markets on November 26 of 2019,its benchmarks include 472 A shares. The MSCI China Index,which includes China A shares and offshore listed shares,include 710 securities representing 4% and 34% of the MSCI ACWI and MSCI Emerging Markets Indexes,respectively. With the latest round of inclusions now accomplished,MSCI also laid out four conditions ahead of consideration of further inclusion: Approve the use of more hedging tools and derivatives; Address the misalignment between onshore China and Stock Connect holidays; Availability of Omnibus trading mechanism in Stock Connect; Allow trades to be settled in a couple of days rather than instantly. Addressing these concerns of foreign participants typically complements the domestic reform agenda and helps spur adoption of international best practices.

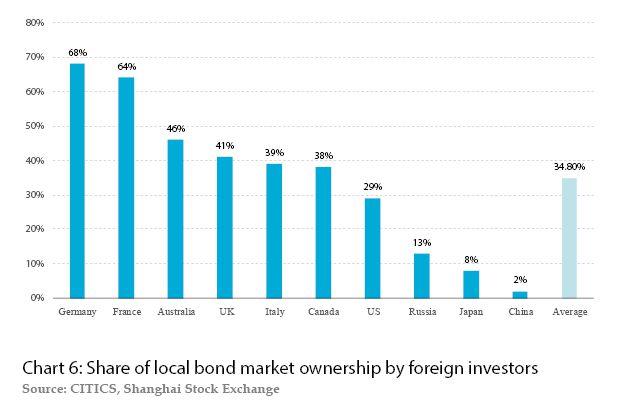

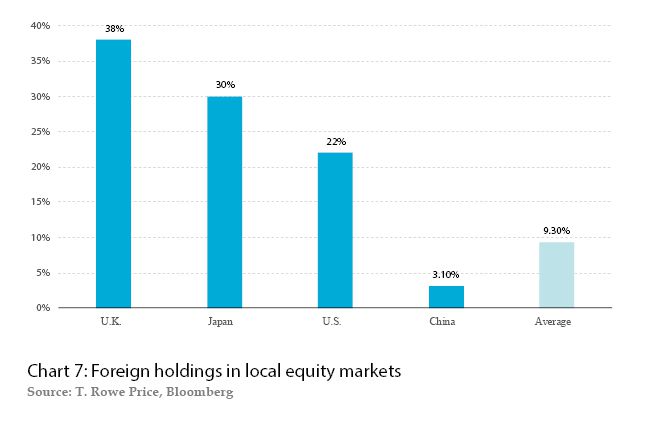

The openness of China's financial sector to the outside world remains low,suggesting there is still plenty of room for further action. As for bond investments,for example,foreign investors have a 68% share in Germany's bond market,64% in France,46% in Australia,41% in the UK,39% in Italy,38% in Canada,29% in the US,13% in Russia and 8% in Japan. Foreign investors account for just 2.5% of China's 100 trillion-yuan market value,which is far below the 23.8% on average of the 10 countries cited here,and if that ratio rose to 15%,holdings would rise to 15 trillion yuan if the amount of bonds remained unchanged (See Chart 6). On the other hand,only about 3.1% of China’s locally listed stocks are owned by foreign investors,compared with 22% in the US,30% in Japan and 38% in the UK(See Chart 7). So obviously,there is much room for China’s financial sector to open up further.

But openness also brings increased risks of spillovers and sudden exit,which need to be managed and contained proactively. (See CGFS Papers No 62 Establishing viable capital markets,January 2019) A portfolio of policies should be considered: Strengthen the regulatory,market environment and domestic macroeconomic policy. Vulnerability to spillovers has been found to be lower in jurisdictions with deeper and more developed domestic financial markets,higher liquidity,and stronger investor protection and corporate governance (IMF,2014,2016),so policies that promote capital market deepening also reduce spillover risk. Enhance regulatory independence and quality. Increase the attractiveness for foreign participants to enter the local market,improve investor protections. A more flexible exchange rate regime could dampen spillovers from global shocks.

To sum up: pushing ahead with reform and building buffers against spillovers and risks of sudden exit,is the key to derive the benefits of internationalization while reducing the vulnerabilities of financial openness.

The author is a visiting scholar at Harvard University and a former managing director at CITIC Securities