China's Drive to Open its Capital Market

China has moved ahead at an accelerated pace in its drive to open up the capital market since President Xi Jinping announced this ambitious agenda at the Boao Forum for Asia in April 2018. The achievements in 2019 were particularly noteworthy.

On the heels of the president’s announcement,governor of the People’s Bank of China (PBOC) Yi Gang revealed the details of a package of 11 measures and disclosed a timetable. This included plans for the long-awaited launch of the Shanghai-London Bond Connect program.

In June 2019 the chairman of the China Securities Regulatory Commission unveiled nine measures to expand foreign access to the financial sector. The plan,announced at the Lujiazui Forum in Shanghai,included expanded circulation of H-shares and by November last year,five of the measures had already taken effect.

More policy initiatives were unveiled on July 20 by the Office of the Financial Stability and Development Committee under the State Council. These allowed foreign-funded institutions to engage in credit rating business related to debt traded on China's interbank and exchange-based bond markets. They also expanded foreign participation in the interbank bond market by allowing foreign institutions to obtain "Class A" underwriting licenses,which grant full access to the debt underwriting business.

China has also reinforced its commitment to opening up the capital market to foreign investors by abolishing quotas and facilitating participation in other ways. Quota restrictions under the Qualified Foreign Institutional Investors (QFII) and Renminbi Qualified Foreign Institutional Investors (RQFII) programs were removed in September 2019. In addition to QFII and RQFII,foreign institutional investors can invest in China's interbank bond market through a number of other channels,including direct investments. In 2019 overseas investors were allowed to conduct non-transactional transfers of bond holdings between a bond account under the QFII/RQFII regime and a bond account under the direct investment framework. This allowed the direct transfer of funds between these accounts. Meanwhile,a foreign entity that invests in the interbank bond market through the above-mentioned channels now needs to make only one filing with relevant authorities.

In addition,there is greater market access for foreign investors in China’s financial services. Overseas financial institutions have been encouraged to participate in the establishment of,and invest in,asset management subsidiaries of commercial banks. China also has allowed overseas asset management institutions to set up joint ventures with Chinese banks or insurance companies to establish wealth management companies controlled by foreign parties. And it has allowed overseas financial institutions to set up pension management companies. These measures have already had an impact. Two foreign-controlled securities companies were set up in March and December last year. China also saw its first foreign-controlled fund management firms in June and December. And the first foreign-controlled asset management company opened its doors in December as well.

China will also scrap shareholding limits on foreign ownership of securities,insurance and fund management firms in 2020,ahead of schedule.

The above-mentioned initiatives provide significantly increased access to China's capital market. The measures taken apply to the stock,bond and futures markets. Both the primary and secondary markets were beneficiaries of the changes,though to differing degrees.

New plans have been mapped out for regional development including the Guangdong-Hong Kong-Macao Greater Bay Area and the guideline to build Shenzhen into a pilot zone for socialism with Chinese characteristics.

Last but not least,the interconnection between domestic and overseas capital markets has been strengthened. The Shanghai Stock Exchange and the Japan Exchange Group established an interconnection system for the cross-listing of exchange-traded funds as of June last year. The Shanghai-London Stock Connect program was formally launched in June,with Chinese investment bank Huatai Securities listing its global depositary receipts on the London Stock Exchange. Eastward business has also been made possible under the program which allows London-listed companies to issue China depositary receipts on the Shanghai bourse. In this way the capital markets of the Chinese mainland and the UK have been linked. Shortly thereafter,MUFG Bank was designated by the People’s Bank of China as a renminbi clearing bank,expanding cooperation between the capital markets of China and Japan.

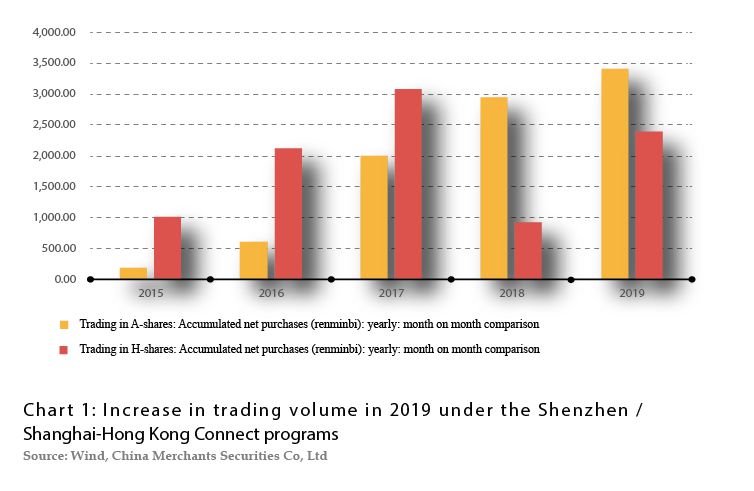

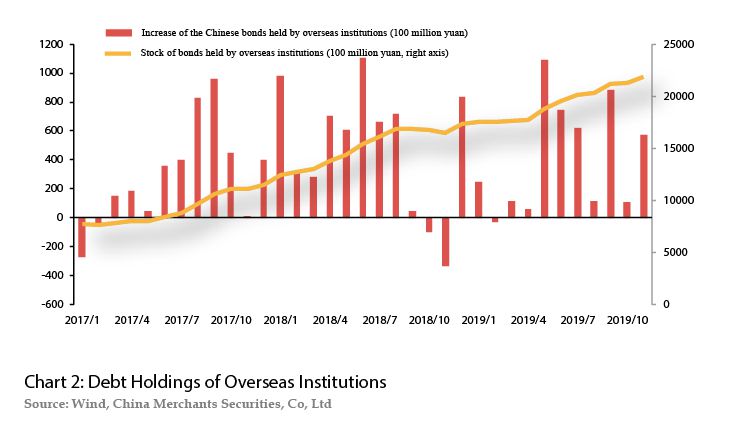

In terms of the stock market,MSCI increased its A-share index weighting to 20% in November,affirming China's progress in opening its stock markets. Other evidence of progress lies in the volume of trading via the Shanghai/Shenzhen-Hong Kong Stock Connect programs. The accumulated net inflow under the program topped 341 billion yuan in 2019,up around 16% over a year ago. The outflow over the same period surged 158.1% to 238.5 billion yuan compared with the previous year. As far as the bond market is concerned,some of China’s onshore bonds will be included in the Bloomberg Barclays index over a 20-month phased-in process starting in April 2020. It is estimated that overseas institutions increased their holdings of Chinese bonds by 10% to 560 billion yuan in 2019 (See Charts 1,2).

Challenges Ahead

China has tackled some major challenges to its plans for a more open capital market. Additional efforts will be needed in the future.

The opening of the credit rating business and granting of "Class A" lead bond underwriting licenses were designed to clear away obstacles to a more open bond market. Similarly,other aspects of the capital market need greater attention so that foreign companies enjoy national treatment and so-called negative list treatment,which permits investment in all areas that are not specifically excluded.

A broader opening of the capital market requires coordinated policies and this requires a closer look at the policies regarding financial derivatives and foreign exchange. Big international investment institutions require sufficient hedging ability when allocating assets. But China's financial derivatives market restricts short selling and there is a dearth of shortage of products. It is worth noting that the global market for fixed income,currencies and commodities is much bigger than the global market for stocks. It is time for China to pay more attention to the futures and foreign exchange markets to make them more attractive to foreign investment.

One regulatory challenge is to maintain a balance between inbound and outbound capital movements. In the primary market,there has been more progress in the outbound segment. At present,about 1,000 domestic companies are listed overseas,including the leading Internet companies such as Baidu,Alibaba and Tencent. Despite past pledges to make headway in this area,there are still no equivalent overseas companies listed in China. In the secondary market,however,China has gone further in attracting foreign investment than encouraging investment abroad. China scrapped QFII and RQFII caps on inbound foreign investment but retained limits on Qualified Domestic Institutional Investor (QDII) and renminbi Qualified Domestic Institutional Investor (RQDII) outbound programs.

In the bond market,offshore investors have been granted access to "northbound trading" in the China mainland market. Nevertheless,domestic investors do not have access to "southbound trading" in the Hong Kong bond market. In the future,as foreign investors take stakes in financial subsidiaries of commercial banks,as well as companies dealing in securities,futures,fund management and wealth management,they will require greater two-way openness in the capital market to meet the requirements of global asset allocations in managing the wealth of Chinese residents.

China is stepping up its effort to address these challenges. During that process,the macro-prudential regulatory system needs to keep pace with the changes so that it can guard against higher volatility in a more open capital market. It needs to raise risk awareness of domestic investors and boost the capabilities of regulatory bodies in research and analysis,market monitoring,risk prevention and crisis response.

Expectations for 2020

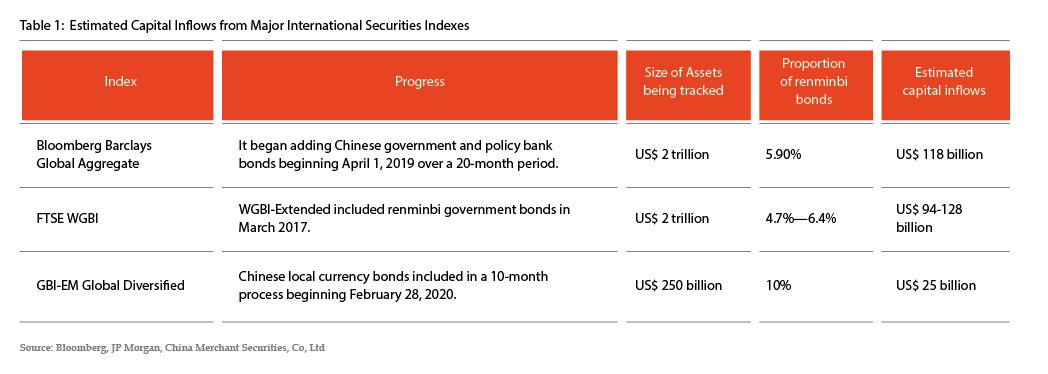

China's progress in opening up the capital market has been recognized by the international market. In the bond market,for example,Bloomberg added Chinese bonds to its Barclays Global Aggregate Index. JP Morgan Chase & Co. included Chinese government bonds in its widely tracked Government Bond Index Emerging Markets (GBI-EM) suite as of the end of February this year. The inclusion is estimated to inject an additional US$25 billion into China’s bond market. Another index provider,FTSE Russell,retains China on its watchlist for a potential boost to the top score of "2" — needed for inclusion in FTSE Russell’s flagship FTSE World. Further information will be released after the mid-term assessment in March 2020 (See Table 1).

China's stock market will see similar advances. As part of FTSE Russell’s inclusion of China A-shares to its global equity benchmarks,the third tranches in phase one will be fully implemented on March 23. At that time,China A-shares will represent 25% of the FTSE Global Equity Index Series (GEIS),and 5.5% of the FTSE Emerging Index.

The inclusion of Chinese bonds and A-shares into international indexes is expected to attract capital into China. In order to maintain its attractiveness to investors and facilitate asset allocation,China will probably relax curbs on outflows of international capital in the near future. The following measures are expected in 2020.

First,there will be further efforts to facilitate bond issues in mainland China by overseas institutions via the panda bond program. Related procedures will become more standardized.

Second,southbound bond trading may become possible at an appropriate time as China is expected to allow domestic investors to invest in offshore corporate debt in 2020. And hopefully,Chinese investors,especially institutional investors,may have access to derivatives and securities margin trading in developed international capital markets,including China's Hong Kong.

Third,China will regulate the acquisition or establishment of offshore subsidiaries by domestic securities companies and fund management firms. This is because some China's Hong Kong subsidiaries of mainland securities companies have shown insufficient capabilities in risk prevention,compliance management and internal supervision.

Meanwhile,along with the relaxed policies on some capital outflows,China will continue to expand channels for interconnection between domestic and offshore markets. China will support the Shanghai-London Stock Connect program,which allows London-listed companies to issue Chinese depositary receipts on the Shanghai bourse and Shanghai-listed companies to issue global depositary receipts on London's stock market. Additionally,the Shanghai/Shenzhen-Germany and the US Stock Connect programs are expected to be included in the Chinese government agenda. Market interconnection programs such as these will help China attain a comprehensive opening of the bond market.

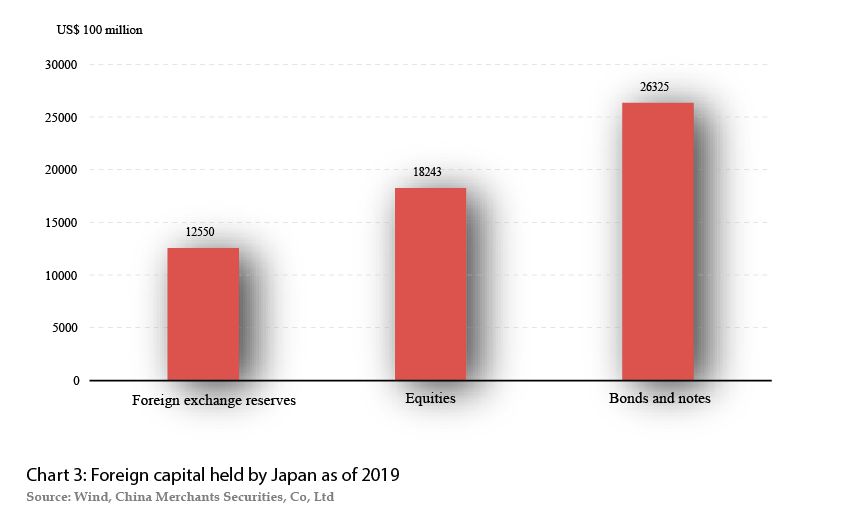

China's market links with Japan may also be strengthened in 2020. Renminbi clearing business in Japan was launched in 2019,laying a foundation for greater China-Japan cooperation in the financial sector. It is likely that the foreign exchange reserves of the Japanese central bank and funds from Japan's private sector will be an important source of foreign capital inflows,and China's bond market is likely to be the main beneficiary. Japan has US$1.26 trillion in foreign exchange reserves,second only to China. It also is a holder of equities worth US$1.82 trillion and another US$2.63 trillion in bonds and notes. At the same time,the yield of Japanese government bonds,more than 40% of which are held by the Central Bank of Japan,has been close to zero or even negative for a prolonged period. From the perspective of interest rates spreads,renminbi government bonds undoubtedly are highly attractive to Japanese investors (See Chart 3).

As China expands access to the domestic capital market,it will be more sensitive to fluctuations in international capital flows. This year is already shaping up as one of increased volatility and international capital flows will have an increased impact on China's foreign exchange,stock,money and bond markets. This means China will need to improve the flexibility of the renminbi exchange rate mechanism. Domestic interest rates will need more flexibility and investors will need to boost their risk awareness. At the same time,the macro-prudential regulatory system must be up to the task of responding to the requirements of more open markets.

The author is a chief macro analyst

at China Merchants Securities