RMB Internationalization: Conditions, Strategies and Risk Prevention

The outbreak of the Covid-19 pandemic in 2020 has severely impacted the global economy,and many major developed economies have fallen into recession. China's economic recovery from its initial setback was quick and robust due to the early control of the outbreak,and that contributed to the impressive performance of the renminbi. There is a view that the internationalization of the renminbi has entered a period of historical opportunity,and now is a good time to vigorously promote it. Against this background,some key questions need to be answered: What is the current state of the internationalization of the renminbi? What conditions need to be met for further gains? What are the key points and strategies of renminbi internationalization? How to prevent risks in the process of renminbi internationalization? These are the main issues this paper attempts to discuss.

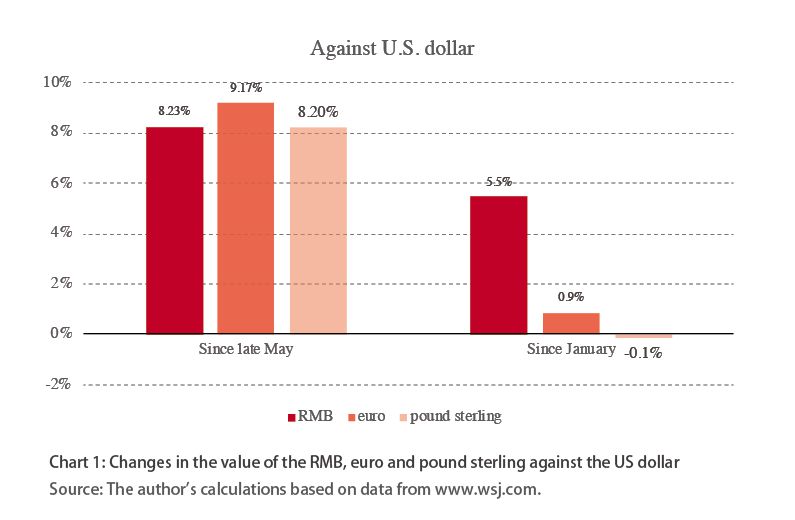

Recently,discussions on the appreciation of the renminbi have been heated. In late May we saw the lowest point of this year's renminbi exchange rate. At that time,1 US dollar was worth 7.17 yuan,but the dollar now fetches only 6.58 yuan. This is incredible: in the very short span of five months,the yuan has appreciated by 8.2% against the US dollar.

But one thing that seems to be overlooked is that it is not just the renminbi that has greatly appreciated against the US dollar. During the same period starting in May,the British pound sterling also rose by 8.2% against the US dollar,while the euro appreciated against the US dollar by as much as 9.2%! (see Chart 1)