China's Debt Landscape: Current Status, Risks, and Strategic Responses amid Global Debt Waves

Since World War II, the expansion of global debt has been intricately intertwined with economic growth. Since 2008, the fourth global wave of debt has driven a rapid rise in China’s macro debt and leverage ratio, making it the world's second-largest debtor. While China’s substantial asset base ensures that overall risks remain manageable, the potential exposure to debt risks amid slowing economic growth and declining macro efficiency demands close attention. Drawing on the global experiences in alleviating debt impacts, deepening reforms and maintaining debt sustainability are crucial. To address its debt challenges, China should prioritize economic development, expand its economic base, optimize the debt structure and enhance efficiency, thereby fostering a virtuous cycle and sustainable growth in the economy, finance, and debt.

Accumulation and Expansion of Global Debt under Capital Globalization and Restructuring of Production Chains

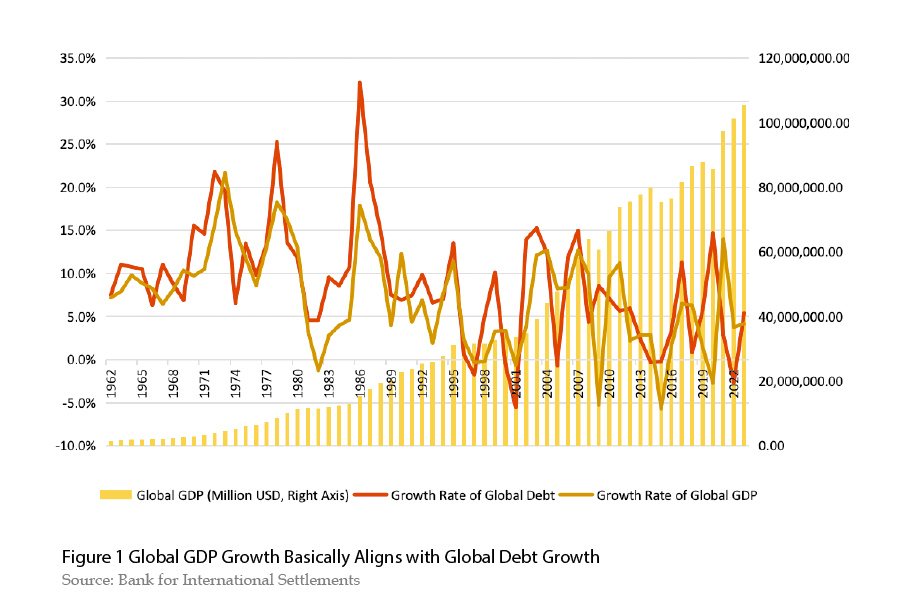

Since World War II, the global economy has experienced sustained growth, accompanied by repeated cycles of debt expansion and accumulation in both developed and emerging economies. The continuous growth of debt size has provided necessary financial support for the development of some countries and regions, with economic growth and debt growth generally proceeding in parallel. However, with the cross-border flows of surplus capital and the restructuring of global production chains, some countries have faced the eruption of risks associated with rapid debt accumulation. These risks have occasionally escalated into global debt crises or widespread financial and economic crises, particularly in contexts of slowing economic growth, declining assets returns, plummeting asset prices, or tightened liquidity in international capital markets.

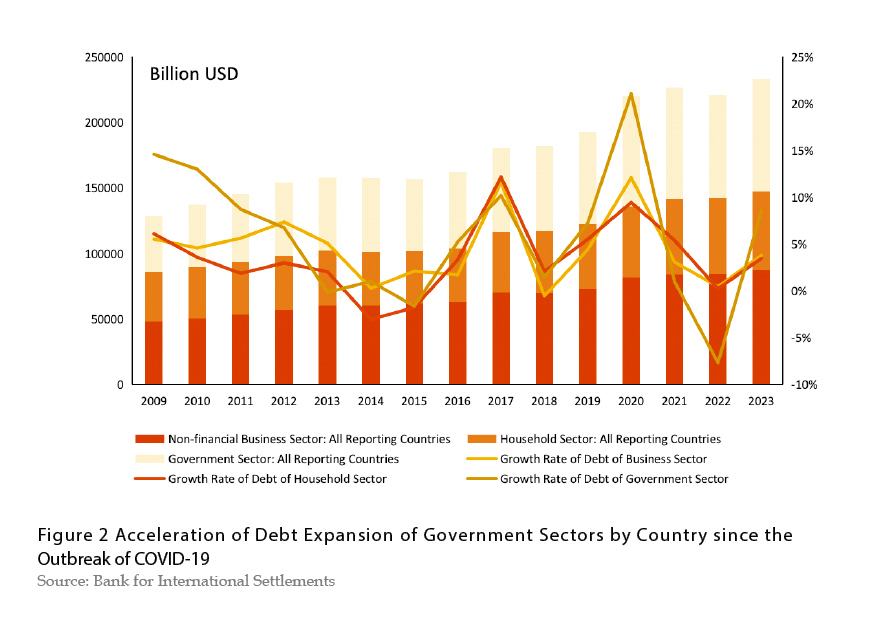

With the arrival of the fourth global wave of debt since 2008, the launch of quantitative easing policies in major economies has driven up global debt levels and leverage ratios. Statistics from the Bank for International Settlements (BIS) show that the global debt reached US$232.8 trillion, with a leverage ratio of 224.9% in 2023. Meanwhile, the burden of debt interest payments continued to rise. The United Nations Conference on Trade and Development estimated that the net interest on public debt in developing countries reached US$847 billion in 2023, representing a 26% increase from 2021. In terms of debt structure, the debt size and leverage ratio of non-financial enterprises were higher than those of the government and household sectors. However, it should be noted that governments in different countries have increased their leverage in recent years in order to cope with the impact of the economic downturn in the aftermath of COVID-19. The government debt increased by 22.6% globally in 2023 compared to 2019, which was higher than the growth rates of debt size observed in both the household and business sectors during the same period. The debt issue in government sectors cannot be ignored.

China’s Debt Growth and Existing Risks

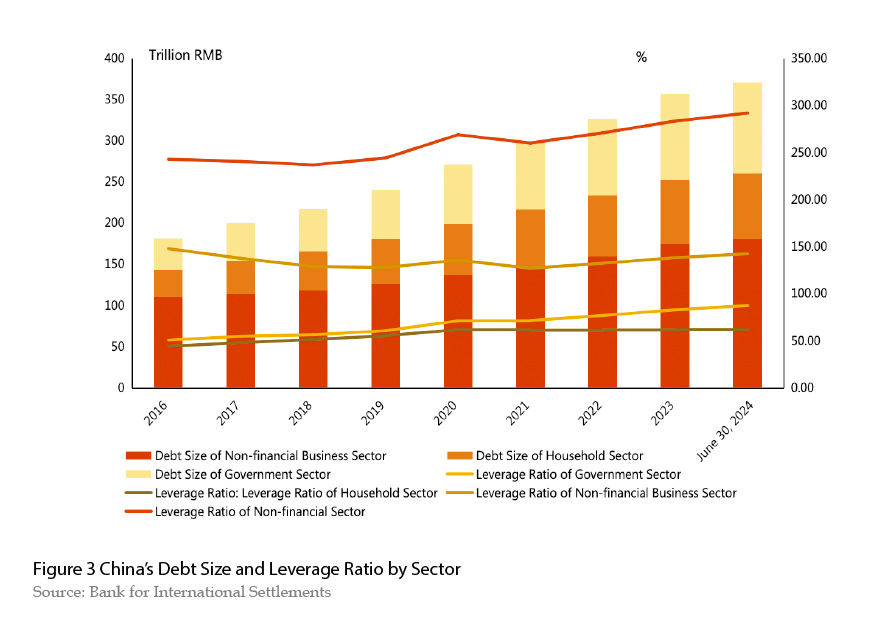

China has experienced rapid debt expansion and an increase in its macro leverage ratio particularly since the 2008 financial crisis. This includes debt expansion mainly through financing platforms in 2008-2009, the macro-level debt growth driven by shadow financing in 2012-2014, the leverage expansion in the household and business sectors spurred by the real estate boom in 2015-2016, and several rounds of debt expansion since 2020 to mitigate the impact of COVID-19. As a result, China’s macro debt size and leverage ratio have exhibited fluctuant increases. According to BIS statistics, as of the first quarter of 2024, China had the world’s second-largest debt size at RMB 368.83 trillion, second only to the US, with a macro leverage ratio of 289.9%. Considering the asset coverage of debt, China’s overall debt risk remains controllable. Using a narrow measure,1China’s sovereign assets reached nearly RMB 780 trillion in 2022, twice its debt size. Moreover, China’s debt structure is dominated by domestic debt, and its domestic saving rate remains high at over 44%, providing a stable internal source of

debt and low exposure to external risks.

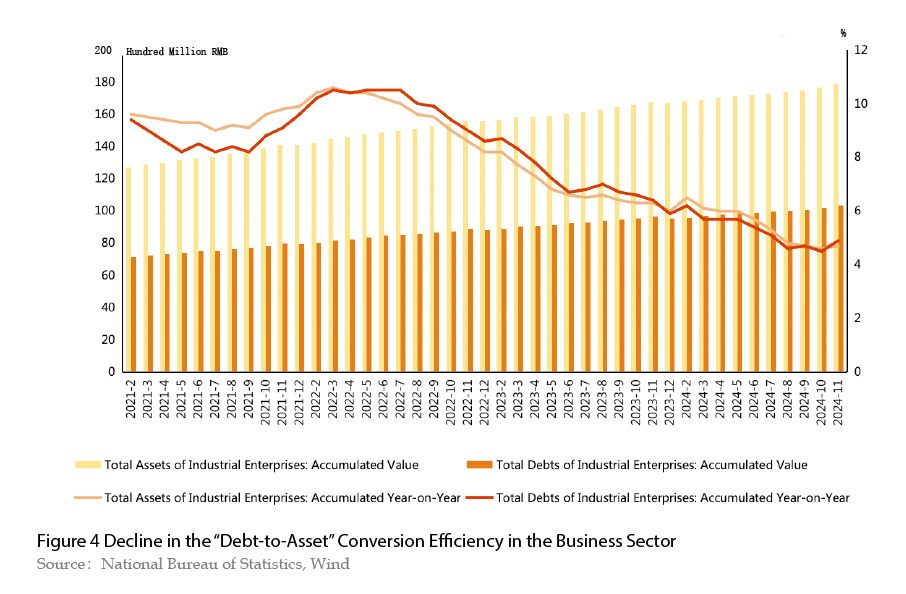

Although existing macro debt risks are generally controllable, it is still crucial to closely monitor the evolution of debt risks amid slowing economic growth and declining macro efficiency. By sector, the leverage ratio of China’s non-financial business sector has continued to rise in recent years, with debt repayment capacity diverging due to uneven asset returns. Currently, the leverage ratio of China’s business sector stands at 142.5% (based on BIS statistics), significantly higher than the levels in both emerging markets and developed economies, where it is generally below 100%. While the growth rate of corporate debt has slowed since 2022, it has still outpaced asset growth, indicating a decline in the “debt-to-asset” conversion efficiency. A marginal improvement in debt efficiency has been observed since the second half of 2023, yet it remains low compared to pre-2022 levels. It is important to note that as the transition from traditional growth drivers to new ones progresses, the divergence in asset returns between traditional and emerging industries is accelerating, leading to a widening gap in debt repayment capacity across sectors.

Currently, given the high and rapidly growing leverage ratio of China’s household sector, the pressure of balance sheet repair requires attention. As of the end of March 2024, the leverage ratio of the household sector had reached 62.6% (based on BIS statistics), marking a nearly decade-high level. While this figure remains lower than that of the US, it places China in the middle tier among major economies. In recent years, the decline in housing prices due to adjustments in the real estate market has significantly impacted household wealth, leading to a slowdown in the growth rate of household assets. This highlights the need to address balance sheet repair and the impact of asset price fluctuations on debt vulnerability in the household sector.

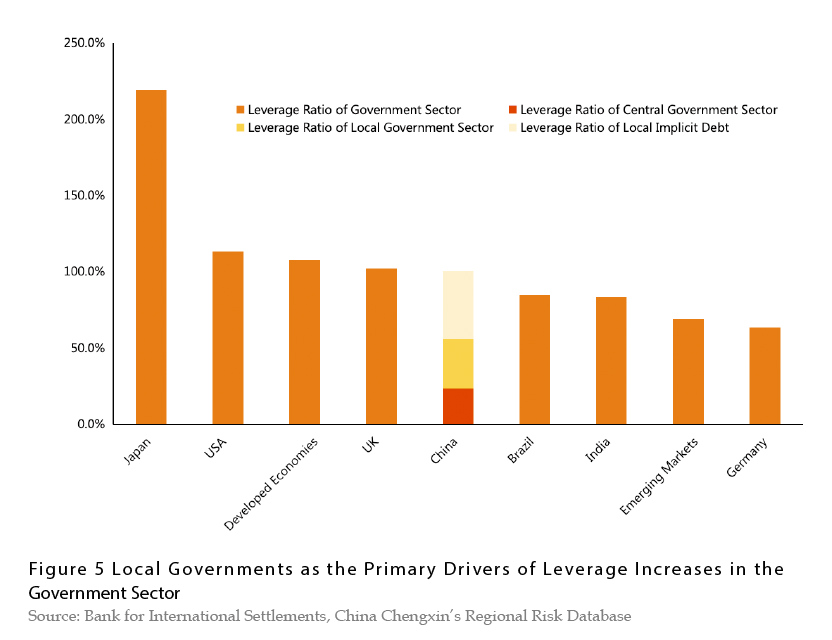

The overall debt risks in the government sector remain controllable, with a focus on liquidity and structural issues. In 2023, the total explicit debt of China’s government sector was 70.7 trillion yuan, and the implicit debt was 14.3 trillion yuan, based on the statistics of the Ministry of Finance. As a result, the total debt amounted to 85 trillion yuan, with a government debt ratio of 67.5%. If estimated based on CCXIimplicit debt statistics, which primarily consists of interest-bearing debt from local government financing vehicles (LGFVs), the government debt ratio would be about 100%. Both results are significantly lower than those of major economies and emerging markets abroad. Given the substantial asset base, China’s government debt risks are generally controllable. However, attention should be paid to liquidity and structural issues. Firstly, there is the pressure of interest payments. CCXI Research Institute estimated that the total interest payments on local government debt, including local government bonds and interest-bearing debt from LGFVs, are likely to exceed 4 trillion yuan in 2024, accounting for over 20% of broad local fiscal revenue. Secondly, there are structural issues in the debt composition. On one hand, both central and local government debt structures need improvement, and there remains significant potential for the central government to increase leverage. On the other hand, as the issuance and use of special-purpose bonds trend towards “generalization”, there is a mismatch between the debt structure and financial resources.

How to Address China’s Debt Issue

Since September 24, 2024, the State Council and relevant ministries and commissions have introduced a series of incremental policies. The focus of these policies has gradually shifted from solely risk prevention to equally emphasizing stable growth and risk prevention. The aim is to directly address balance sheet repair in three sectors through development-driven solutions, thereby alleviating debt pressure across all sectors. Particularly regarding local government debt, the implementation of a large-scale “6+4+2” debt removal measures2 significantly mitigates local liquidity pressure and frees up resources and time for development. Meanwhile, shifting the debt removal approach from “development through debt removal” to “debt removal through development” also positively impacts deep-level institutional reforms and fundamental changes in local behavior patterns and incentive systems.

Considering that the current challenges faced by China’s economy are not merely cyclical but more structural, in addition to enhancing short-term counter-cyclical regulation, it is more imperative to continuously advance structural reforms to further unleash development potential, while attaching importance to debt structure and efficiency.

Unleashing economic development potential through structural reforms and facilitating the shift from traditional to new growth drivers. First, market-oriented reforms in factor markets should be promoted, land supply structures optimized, household registration system reforms deepened, the role of capital clarified, and a data-driven factor market cultivated. These measures will guide the flow of resources and production factors into more efficient sectors. Second, supply-side reforms should be integrated with the strategy of expanding domestic demand, using supply-side structural reforms to drive industrial upgrades. Third, efforts should be made to optimize the business environment and unleash the vitality of market entities, particularly the private sector. Fourth, while fostering new growth drivers, it is also important to guide a smooth transition for traditional drivers, such as the real estate sector.

Enhancing the driving force of innovation in economic development and vigorously developing high-quality productive forces. First, it is essential to optimize and upgrade industrial and supply chains, implement technological transformation and upgrading programs in manufacturing, and promote the high-end, intelligent, and green transformation of traditional industries. Second, emerging and future industries should be actively nurtured, focusing on consolidating and expanding leadership in sectors such as intelligent connected new energy vehicles. Additionally, new growth engines such as biomanufacturing, commercial aerospace, and the low-altitude economy should be developed, while exploring new fields like quantum technology and life sciences. Finally, digital economy innovation should be further advanced, promoting the deep integration of digital technologies with the real economy.

The supply of people-centered public services should be increased to reduce the "crowding out" effect on household consumption by enhancing social security. At the same time, more employment opportunities should be created to ensure income, boost household consumption, and unleash the driving force of domestic demand on economic growth. First, efforts should be made to accelerate the improvement of elderly care services in rural areas, provide diversified services, and vigorously develop the "silver economy". Second, there is a need to increase the supply of childcare services and improve the fertility support policy system. Third, efforts should focus on increasing the supply of high-quality healthcare and education services and promoting a more balanced distribution of healthcare and education resources. Fourth, priority should be given to increasing job opportunities, removing unreasonable restrictions in the recruitment process, and addressing structural unemployment issues.

There is still room for improvement in broad infrastructure, which can play a key role in driving investment. Due to its large population base, China’s per capita infrastructure capital stock is only 20% to 30% of that in developed countries. The demand for traditional infrastructure still exists. Additionally, with the urbanization rate based on the household registration system still around 50%, there is substantial potential for people-centered urbanization. Furthermore, the rapid adoption and application of 5G, big data, and artificial intelligence have increased the demand for supporting infrastructure. Overall, China’s investment demand potential remains significant. Going forward, there is room to increase investment in infrastructure, particularly in green infrastructure, 5G, smart transportation, and smart cities.

While expanding the "base", it is also essential to focus on optimizing the debt structure, improving efficiency, and creating a virtuous cycle with economic growth. To optimize the debt structure, several key actions should be taken: First, the scale and structure of new debt should be determined based on effective demand, with an emphasis on fiscal sustainability. Second, the structure of new investment should be optimized, ensuring that investment aligns with the goals of high-quality economic development. Third, efforts should be made to further increase leverage at the central level to ease the debt burden on local governments, thereby enhancing local vitality. At the same time, it is essential to improve the efficiency of debt utilization, especially local government debt. The first is to ensure the continuity of funding for existing valid projects. The second is to continue revitalizing existing assets based on the construction of the balance sheet. The third is to reduce inefficient and ineffective government spending on infrastructure. Fourth,prudent pre-investment evaluations should be conducted, the operational efficiency of projects after investment should be improved, and the “debt-to-asset” conversion efficiency should be enhanced. In addition, sustainable local government debt requires structural reforms, clearer central-local and government-market relationships, and faster establishment of long-term mechanisms.

YUAN Haixia is the Executive Dean of CCXI Research Institute and a government debt advisory expert at the Ministry of Finance