China is One of the Main Promoters for Global Services Opening-Up

Author:WANG Wei, LIU Tao and LIU Xin

This paper is based on a joint evaluation conducted by the Development Research Center of the State Council (DRC) and the Organization for Economic Co-operation and Development (OECD) on the progress,effectiveness,and characteristics of the service sector worldwide over the past five years,spanning from 2018 to 2022. The evaluation focuses on five key aspects: foreign entry,movement of people,non-discriminatory treatment,free competition,and regulatory transparency. Based on the Service Trade Restrictiveness Index (STRI) developed by the OECD,this assessment establishes the Services Openness Index (SOI) as a measure to compare and analyze the progress in opening up the service sector in 50 countries. These include 38 OECD countries and 12 major emerging markets and developing countries,collectively representing more than 80% of global trade in services,rendering them highly representative.

The Opening Up of Global Service Sector is Advancing in Waves

Over the past five years,there has been a major transformation in international dynamics at an unprecedented pace,and some nations around the world progressively opening up their sectors in waves. While the mainstream and general trends remain unchanged,many new trends of opening-up have emerged in various countries,on areas with regard to opening-up,policy choices and regulatory adjustments.

Affected by multiple factors,such as the COVID-19 pandemic,the openness of service sector has recovered from a downward trend

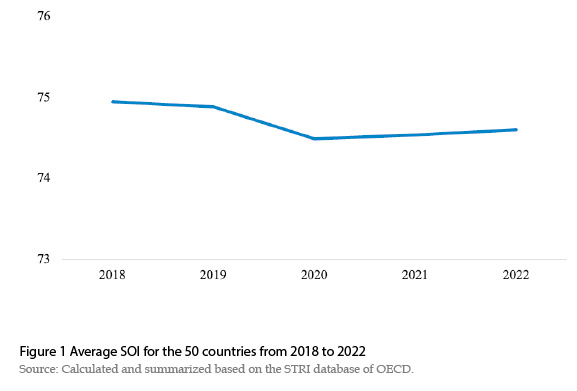

In recent years,there has been a resurgence of unilateralism and protectionism,posing a threat to the openness of the global service sector amidst significant headwinds encountered by economic globalization. The SOI,evaluating the openness of service sector for 50 countries around the world (hereinafter referred to as the 50 countries),saw a decline in 2018 and 2019 due to heightened security reviews of foreign investment in certain industries by certain countries. In 2020,compounded by the impact of the COVID-19 pandemic,some countries adopted temporary control measures to restrict the movement of people,making it less convenient for employees in service sector to move across borders. Some developed countries intensified screening for foreign investment and imposed conditions on acquiring production factors in many industries,resulting in the average SOI for the 50 countries falling to 74.5 in 2020,a 0.5% decrease from the previous year. Since 2021,many countries have lifted the temporary control measures,and the service sector has gradually opened up again,causing the average SOI for the 50 countries to rise slightly to 74.6 in 2022,albeit still below the pre-COVID level (see Figure 1).

Major emerging markets and developing countries are the driver for further opening up service sector

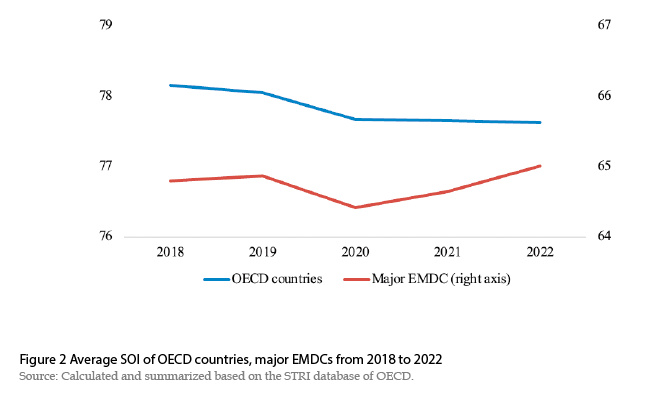

Although the openness of service sector in OECD countries is generally high,it has declined somewhat in recent years. Since 2018,the average SOI OECD countries has decreased incrementally each year,reaching 77.6 in 2022,down by 0.7% from 2018. In contrast,major emerging markets and developing countries (EMDCs) are actively opening up their service sectors. Apart from a slight decrease in 2020 due to temporary COVID-19 control measures,SOI of major EMDCs in other years all showed a general upward trend. In 2022,the average SOI in major EMDCs reached 65.0,0.9% higher than in 2020,reaching the highest level in the past five years. This narrowed the gap with the OECD average. In 2022,the average SOI for OECD countries was 19.4% higher than that of major EMDCs,with a gap of 12.6,which narrowed by 5.7% compared to that in 2018 (see Figure 2).

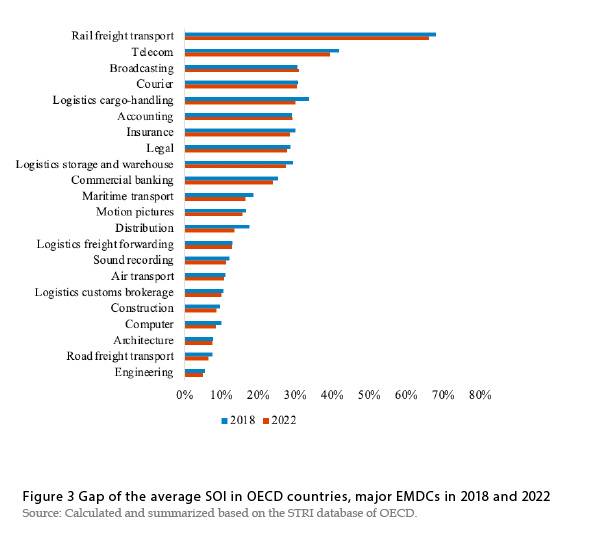

Developed countries enjoy clear advantages in opening up natural monopoly industries,such as rail freight transport and telecom

In 2022,the average SOI of OECD countries for 22 service industries was consistently higher than the average of major EMDCs,but the gaps between the two types of countries varied in different industries. OECD countries initiated deregulation in natural monopoly industries like rail freight transport,telecom,courier,and broadcasting at an earlier stage,resulting in these industries being more market-based. Consequently,their average SOI is significantly higher than that of major EMDCs,showcasing clear advantages in openness. Although major EMDCs are actively promoting relevant reforms,the gaps between the two types of countries still exceeded 30% in 2022 for the aforementioned industries. Specifically,for rail freight transport,the average SOI of OECD countries was 66% higher than the average SOI of major EMDCs. However,for industries that are highly market-based and seldom involve sensitive issues like national security (e.g.,engineering,road freight transport,and architecture),the gap between the average SOI of major EMDCs and OECD countries was not as substantial. In 2022,these gaps were all less than 10%,indicating a narrowing trend (see Figure 3).

The circulation industries remain the focus for services opening-up

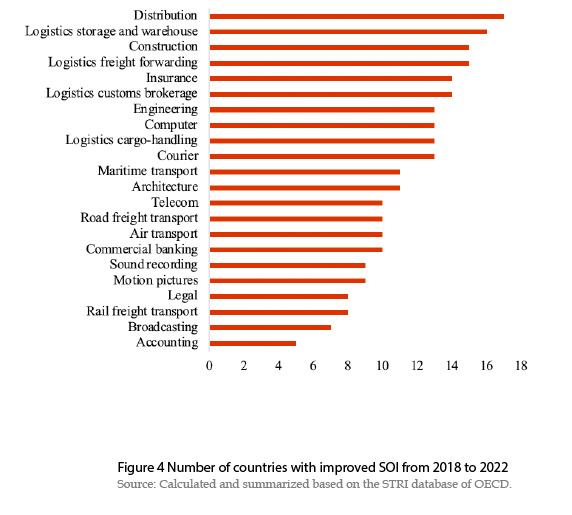

Influenced by the rise of trade protectionism,concerns related to national security,and other factors,policies governing the opening of service industries,such as sound recording and telecommunications,in many countries have tightened somewhat over the past five years. Conversely,circulation services,which play a crucial role in global industrial and supply chain operations as well as trade network connectivity,have garnered significant attention from numerous nations. In the past five years,most countries have maintained their original and relatively high level of openness,and the SOI of distribution,logistics,courier and other related industries in more than 10 countries has further increased. This contrasts with the number of countries showing higher SOI in accounting,legal,and broadcasting industries (see Figure 4). As countries have expanded their openness in circulation industries,they have not only increased regulatory transparency but have also implemented a variety of measures to open up various industries. Among them,regarding distribution,air transport,logistics cargo handling,the level of openness was enhanced by easing restrictions on foreign entry and reducing competition barriers. For courier and logistics storage and warehouse,the index of openness was improved by reducing competition barriers.

Easing restrictions on foreign entry is the primary measure for emerging markets and developing countries to promote opening-up

Over the past five years,the average SOI on foreign entry has remained essentially stable. From a national perspective,some countries have tightened foreign entry,but more than a dozen countries,primarily EMDCs,have introduced various opening-up measures and continued to relax foreign entry. China,India,and Brazil have eased conditions on the transfer of capital and investment in services. Moreover,China,Vietnam,Indonesia,and other countries have relaxed foreign equity restrictions in service industries,including insurance,broadcasting,and air transport. Additionally,Vietnam,Brazil,and other countries have abolished nationality or residency requirements for boards of directors or managers in certain service industries. Finally,China and Vietnam have eased screening requirements for foreign investment in specific service industries. In addition,a few developed countries,such as the UK and Denmark,have also relaxed restrictions on foreign equity,legal forms,and commercial presence requirements for certain service industries.

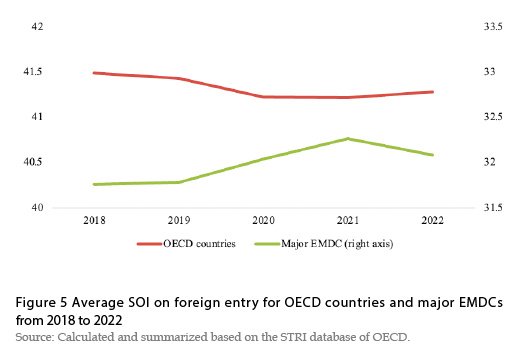

The average SOI on foreign entry in OECD countries is already relatively high,making the relaxation of foreign entry less of a priority in their opening-up efforts. However,EMDCs place more emphasis on the role of broader foreign entry in further opening up services and actively introduce measures to enhance openness. In 2022,the average SOI for major EMDCs was 32.1,a 1% increase from 2018,narrowing the gap with the OECD average by 2 percentage points compared to 2018 (see Figure 5).

Continuous adjustment and optimization of domestic regulations on service sector

Most countries prioritize effective competition in services and actively strive to create an enabling business environment. EMDCs have actively eliminated discriminatory measures against foreign-invested enterprises over the past five years. In 2022,the average open index on non-discriminatory treatment was 6.1,an increase of 2.2% over 2018. However,some developed regions,such as the European Union,have placed greater emphasis on further opening up their intraregional services market,introducing relevant laws and regulations on fair participation in government procurement and other areas,and promoting fair competition among businesses in the region. This resulted in a 6.4 percentage point reduction in the gap between average SOI on non-discriminatory treatment for both types of countries from 2018 to 2022. However,as a whole,OECD countries place more emphasis on regulatory transparency than EMDCs. In promoting market competition,both types of countries have made similar efforts.

New rules of services opening-up have emerged as the times required

With the recent surge in the new round of technological revolution and industrial transformation,the digitalization of services has accelerated significantly,and cross-border trade in services has experienced rapid development. The global pandemic has further provided practical momentum to this mode. Currently,the proportion of cross-border trade in services in the total volume of global trade in services has risen to about 30%,making it a major mode second only to commercial presence,while new high-standard economic and trade rules have emerged accordingly. For example,the United States-Mexico-Canada Agreement and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership all put forward new rules prohibiting local presence in cross-border services trade,which is equally authentic as core rules on market access,national treatment. In the industries such as legal,accounting and engineering,where cross-border trade in services is the main mode,the US,the UK and Canada do not regard local presence as a condition for cross-border supply of services. And Japan,in the legal service industry,also does not require local presence. Moreover,less than half of the evaluated countries have not made adaptive adjustments in this regard.

China has Achieved Remarkable Progress in Service Sector Opening up

As the largest sector in China's economy,the service sector has emerged as the primary focus for the country's extensive high-level opening-up efforts. In recent years,the Chinese government has remained firm in opening up the service sector,especially since the concept of "institutional opening up" was put forward in 2018. Substantial progress has been made in the institutional opening-up of services,with gradual relaxation of restrictions on foreign entry,continuous optimization of the business environment,and remarkable achievements in various aspects,making China as one of the important drivers in opening up global service sector.

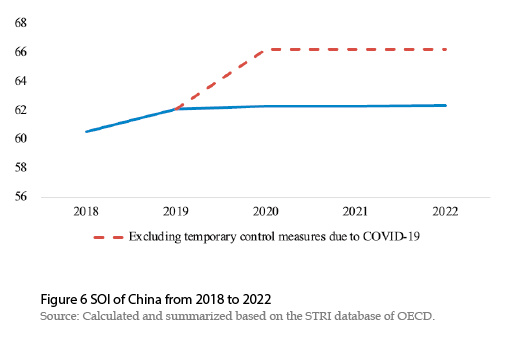

The pace of services opening up is accelerating in more extensive areas

Over the past five years,China has actively championed the opening up of the service sector by fostering an enabling business environment,facilitating foreign entry,and promoting fair competition. Consequently,the level of services opening up has consistently shown an upward trend. In 2022,the SOI of China was 62.3,3% higher than that in 2018. During the COVID-19 pandemic,China implemented temporary control measures; however,these measures have since been lifted and are not anticipated to impede further opening up of the service sector in the future. Excluding the impact of the above factors,China's SOI would reach 66.3 in 2022,9.6% higher than in 2018 (see Figure 6).

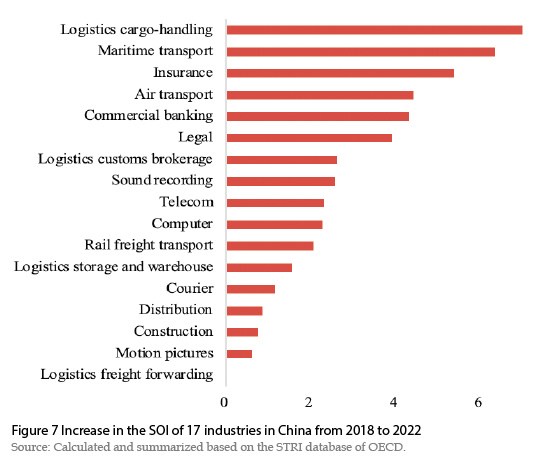

China has further shortened the Special Administrative Measures for Foreign Investment Access,a move that has further broadened the scope of opening up the service sector. The 2021 version of the Special Administrative Measures for Foreign Investment Access had a total of 23 measures related to services,representing a decrease of 9 measures from the 2018 version. Restrictions on access to transport,storage and postal services,water conservancy,environmental and public facilities management,culture,sports and entertainment,and finance have been significantly relaxed (see Table 1),further opening up these service industries. Over the past five years,the SOI of 17 service industries in China has improved to varying degrees,while transport and finance are among the top performing industries (see Figure 7).

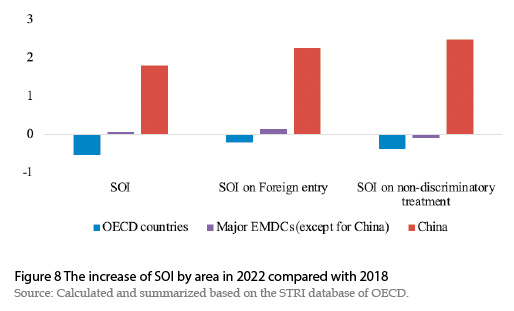

China’s strength to open up service sector exceeds global average

Over the past five years,China's SOI has increased by 1.8. The increase was 2.3 higher than the OECD average and 1.7 higher than the average of the 11 other EMDCs,especially for foreign entry and non-discriminatory treatment. From 2018 to 2022,the average SOI on foreign entry for 22 service industries in China increased by 2.3,while the average of other EMDC only increased by 0.1,and the OECD average decreased by 0.2. The average SOI on non-discriminatory treatment for 22 service industries in China increased by 2.5,while those of OECD countries and other EMDCs decreased by 0.4 and 0.1 on average,respectively (see Figure 8). In addition,in the past five years,the number of service industries in China with a higher openness index was 17,significantly higher than the average of other countries,5 more than the average of other EMDCs,and 16 more than the OECD average.

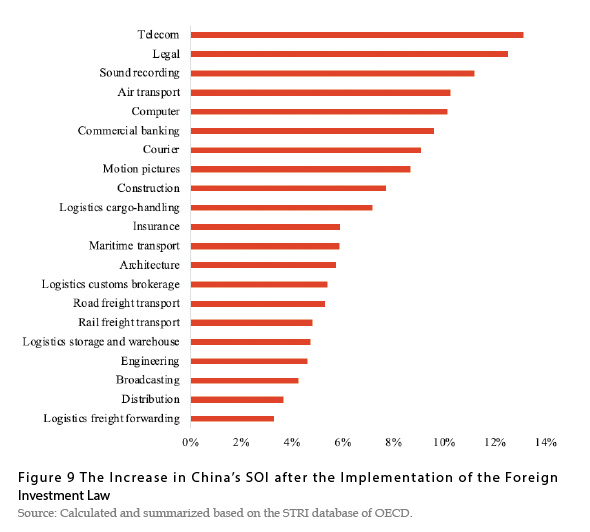

Higher level of services opening up by benchmarking international conventional regulations

Establishing a basic legal framework for foreign investment is of the utmost importance. In order to meet the needs of opening up in the new era,China has promulgated a new Foreign Investment Law,which came into effect in 2020. The Law of the People’s Republic of China on Sino-Foreign Equity Joint Ventures,the Law of the People’s Republic of China on Wholly Foreign-owned Enterprises and the Law of the People’s Republic of China on Sino-Foreign Cooperative Joint Ventures were repealed simultaneously. More importantly,the new Foreign Investment Law removes many restrictions and facilitates foreign entry into the service sector. To be more specific: First,the constraint of "explicitly considering economic interests in screening" is now eliminated. No matter whether they are covered by Special Administrative Measures for Foreign Investment Access,all industries are no longer subject to the requirement that screening explicitly considers economic interests. Secondly,there will be no conditions for the transfer of capital and investments,and the relevant restrictions on all industries have been removed. Thirdly,discriminatory measures against foreign suppliers in government procurement are abolished. It is clearly stipulated that the State will ensure that foreign-invested enterprises can participate in government procurement activities through fair competition. Thanks to the implementation of the Foreign Investment Law,in 2020,the increase of SOI on foreign entry in 17 industries varied from 2.9% to 15.8%,and the increase of SOI on non-discriminatory treatment in 21 industries varied from 25.2% to 120%,both compared with the previous year. In general,SOI of 21 industries improved to varying degrees,with the telecommunications industry showing the most notable increase of 13.1% (see Figure 9).

There are also measures for specific industries that effectively improve SOI of service industries on a scale of 1 to 10.

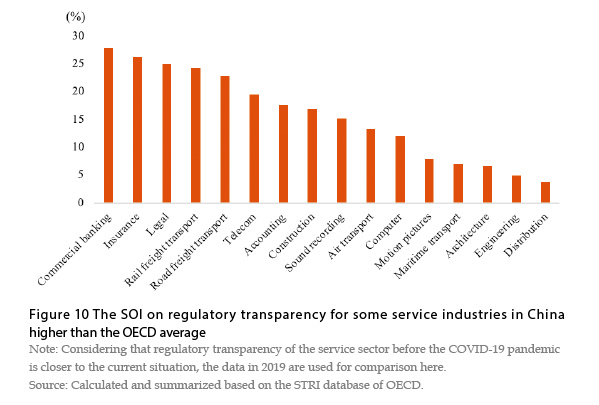

Regulatory transparency in some service industries has reached a relatively high level

In further opening up the service sector,China has focused on the continuous reform of the review and approval system on services,which has continuously improved the business environment and regulatory transparency of the service sector. Notably,China has enhanced regulatory transparency in the service sector through a series of measures,including the reduction of visa processing fees and the facilitation of business startups. Additionally,industries such as construction,accounting,courier,telecommunications,and computer services have gradually transitioned to accepting applications for electronic licenses,simplifying operational processes for companies. In 2019,the year preceding the COVID-19 pandemic,the SOI on regulatory transparency of 16 service industries in China exceeded the OECD average (see Figure 10).

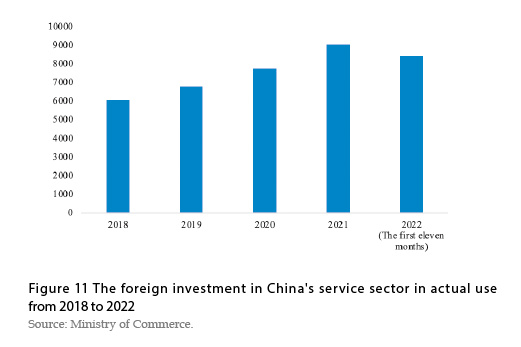

Greater openness in the service sector improves the quality and quantity of foreign investment

China's continuous efforts to open up the service sector have attracted more and more foreign-invested enterprises to China. Over the past five years,foreign investment in actual use in China's service sector maintained a rapid growth overall. From 2018 to 2021,the foreign investment in services in actual use increased by 14.4% annually on average. In the first 11 months of 2022,the foreign investment in the service sector in actual use reached 842.61 billion yuan,exceeding the entire year of 2020 and increasing by 39% compared to 2018 (see Figure 11). In addition,the structure of foreign investment in China's service sector in actual use has been continuously improved,as the proportion of foreign investment in high-tech services in actual use has increased significantly,exceeding 40% in 2022.

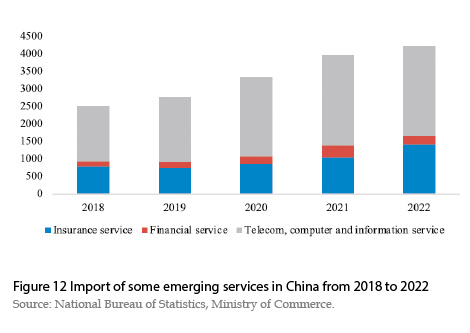

Opening service sector brings new opportunities to the world

As China's service sector further opens up,its domestic services market has developed rapidly,driving the growth of relevant services import. This not only promoted China’s high-quality development,but also provided more development opportunities for countries around the world. Taking emerging services trade as an example,in 2022,China’s total imports of insurance,finance,telecommunications,computer and information services reached 421.49 billion yuan,an increase of 68.6% over 2018. In terms of breakdown,the import of financial services exhibited the largest growth,increasing by 79.6% compared to 2018,and imports of insurance services,and telecom,computer,and information services increased by 78.7% and 62.6%,respectively,compared to 2018 (see Figure 12).

Policy Prospect

Looking ahead,China is steadfast in its commitment to promoting the high-level opening up of services. The country plans to further relax market entry for services,enhance the openness of cross-border trade in services,expand the functions of open platforms,and strive to establish a high-standard institutional system for opening the service sector. China is ready to work with other countries to build a world economy of open cooperation,innovation,and shared growth,build a community with a shared future for mankind,promote common prosperity and progress,and bring more stability to the dynamic world.

The author WANG Wei is the former general director and senior research fellow of the Institute for Market Economy,Development Research Centre of the State Council

The author LIU Tao is deputy director of the Institute for Market Economy,Development Research Centre of the State Council

The author LIU Xin is associate research fellow of the Institute for Market Economy,Development Research Centre of the State Council