The Intractable Post-Pandemic Inflation Puzzle

Burgeoning demand effect,cost-driven scenario and supply chain bottlenecks are the main factors leading to higher-than-expected U.S. price increases. The Fed’s efforts to re-inflate,coupled with the strong fiscal stimulus,make the inflation outlook unpredictable. This will inevitably have spillover effects on other economies including China.

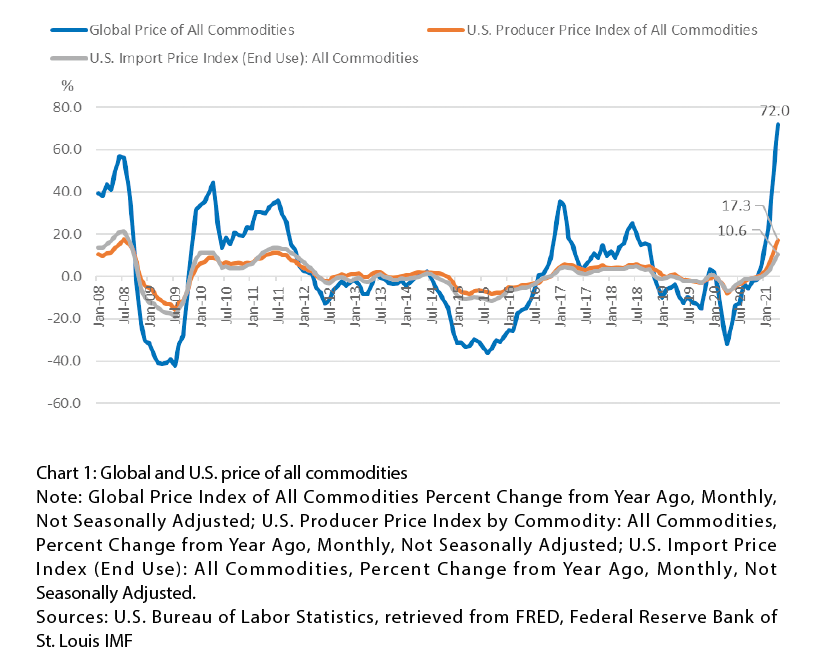

Affected by multiple factors such as extremely loose monetary and fiscal policies,brighter economic reopening prospects,and supply chain bottlenecks,there has been a surge in inflation around the world in recent months. In April,the Global Commodity Price Index rose 72% from a year ago,much higher than January’s 14.9%; U.S. PPI and CPI rose 6.2% and 4.2% respectively,the highest level since 2008,while core CPI rose 3% and set a new high since 1996; in China,although the CPI only rose 0.9%,the PPI rose to 6.8%. (see Chart 1) With the gradual economic reopening of various countries but the uneven control of the pandemic,especially the global supply chain severely impacted,where the inflation will be trending up,and how the extremely loose monetary and fiscal policies will be adjusted accordingly have become the focus of attention.