China's Economy and the 'New Cycle' Debate

Since the beginning of 2017,China's economic data has improved,but economists have markedly different views on the durability of this upturn. Some see the stabilization of the global economy and China's supply side reforms as signaling something much brighter ahead. They see more innovation and new development models taking shape. They also see this as pointing to a new economic cycle in the near future. Other economists contend China's economy is still in a phase more accurately described as "darkness before the dawn." There is an inkling of a new cycle,but it has not been firmly established. More patience and further observation are necessary. Still others contend that without significant reform and more innovation,it is difficult for China's economy to enter into a new cycle. Thus the current judgment that China's economy has entered into a new cycle is groundless. So,is China's economy really entering into a new cycle? What are the characteristics of a new cycle and what kind of innovations and institutional vitality would be needed? What kinds of government support policies are needed?

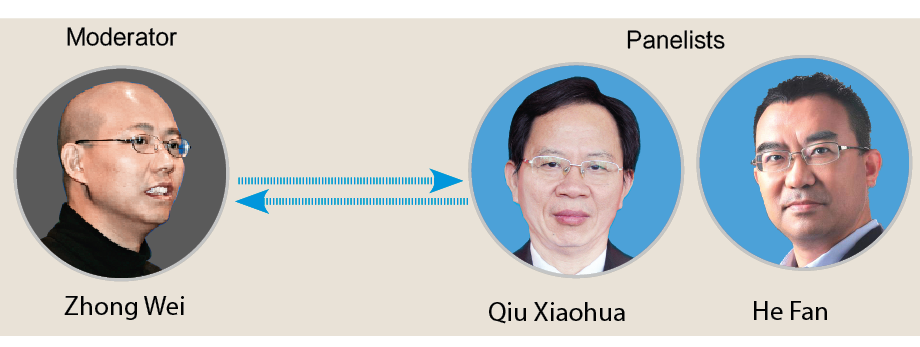

Zhong Wei,deputy editor-in-chief of China Forex,leads the discussion with Qiu Xiaohua,chief economist of Minsheng Securities,and He Fan,professor of economics at HSBC Business School of Peking University,director of the Research Institute of the Maritime Silk-Road of Peking University.

Zhong Wei: From the second half of 2016 to the first half of 2017,a number of China's economic indicators have showed an upward trend,contrary to some previous expectations. How do you view the Chinese economy at this point? What are the reasons for the improved macroeconomic data in the first half of this year? Is it mainly due to improved macro-control and regulation? Does it indicate that China's economy is gradually entering into a new stage or a new cycle?

Qiu Xiaohua: China's economic downturn,which began in 2010,is coming to an end and a new cycle is about to begin. I can boldly predict that the new cycle will start in the second half of 2018. This cycle marks a new era. It can be said that the Chinese economy is on the verge of this new era and the reasons are as follows:

First,economic indicators show a change for the better. The improving trend can be seen in the indexes of purchasing managers,the ex-factory prices of industrial goods,power generation,freight volume and the volume of credit. This means that the economy is gradually recovering. Second,the economic trend is stable. The year-on-year growth rate in the first three quarters of last year was 6.7% and it ticked up to 6.8% in the fourth quarter. In the first quarter of this year it was 6.9% and it maintained that pace in the second quarter. For the third quarter,growth is expected to be no less than 6.8%. Third,it can be seen that there is new economic momentum,and this is cushioning the effects of the economic slowdown of the past. High-end manufacturing as well as a variety of other new sectors are enjoying double-digit growth and supplying this new momentum. Fourth,it can be seen that the world economy is recovering. China's foreign trade this year has been good,with exports achieving growth of 15% in the first half of the year. Fifth,the policy cycle is also being fine-tuned,indicating that policy makers are less worried about China's short-term economic fluctuations. Sixth,a new political cycle has started. Political leaders will be cracking down on official misconduct,making effective governance their top priority. The convergence of the political cycle and the economic cycle suggests that China is approaching a new round of development.

He Fan: China's economic performance in the first half of the year was slightly better than expected,mainly because the economy is readjusting. This readjustment probably started in the second half of last year and ended in the first half of this year. The reason for the readjustment was investment in restocking inventories. As a result of the efforts to cut overcapacity last year,prices of coal,steel and other raw materials began to rise. Downstream enterprises needed to boost their inventories in order to cushion themselves against future cost pressures. This is the main reason for the increase in inventory investments.

However,this round of readjustment ended in the first half of this year. The supporting reasons are that first of all,the efforts to rebuild inventories cannot last forever. Second,consumption is unlikely to see much of an upturn in the near term. Third,in terms of imports and exports,the US government is still engaged in protectionism,and anti-globalization sentiment is strong. Fourth,in terms of investments,government stimulus spending will not match the extent seen in the past. Meanwhile,private investment,which remains promising,is not likely to accelerate too quickly. Profits,though improved,are not increasing for all businesses. Enterprises with better profits are basically large state-owned companies and medium-sized upstream enterprises. While the profits of upstream businesses increase,this may erode the profits of downstream companies. The present producer price index has rebounded smartly,but the consumer price index has not risen significantly. The current recovery in corporate profits is more related to supply-side reforms. Fifth,even if investment increases,the economy will not necessarily achieve high growth. People tend to confuse the concepts of fixed asset investment and fixed asset formation. The growth in the gross domestic product depends on the formation of fixed assets. In recent years,the gap between fixed asset investment and asset formation has gradually widened. Therefore,in general,China's economy is still at the bottom of an L-shaped trend. New economic growth momentum has not yet appeared,so a new cycle has not arrived at this point.

Zhong Wei: How would we distinguish a new cycle from the previous one? Are there differences between the present growth pattern and the pattern of old? What are the chief characteristics of China's economy at present?

Qiu Xiaohua: In this new cycle,China's economy will behave differently than in the past where the focus was on development at all cost,regardless of the damage to the environment or public well-being. It will be different in the sense that high input levels,high consumption levels,and high debt levels will not be used in pursuit of high growth. The new cycle will focus on quality of goods and services,improvement in the environment and enhancing the well-being of the people. Development will be driven by innovation,coordination,green policies,openness and sharing as the main theme. With the continuous upgrading of China's consumption patterns and the improved performance of government administration,a new development cycle can be anticipated.

He Fan: We need to look at the three pillars of support for economic growth. First,is investment,and here we see that due to limited funds,it is not possible to use infrastructure investment to the same extent as before in order to stimulate economic growth. In the past,local investment was financed mainly by bank borrowing and funds from local financing platforms. But the central government is paying much more attention to local debt now as it tries to maintain greater control over the spending of local governments. In addition,the appetite for fixed investment from the private sector is weak at the moment. The second economic pillar is exports,and here we face the problem of protection on a global scale. This makes it difficult for exports to see a big upturn in the near term. The third pillar is consumption,and this has been relatively stable,though the market for durable goods is relatively saturated. Although we may see a gradual improvement here,growth will not match the levels of the past when comparisons were with a very low base. The key to future growth is in supply side reform in the service sector. At present,health care and care for the elderly are areas of strong demand,but inadequate supply is holding back consumption of these services.

Zhong Wei: People like to talk of economic cycles and how they relate to reform as well as how economic cycles relate to macro-controls. Many economists contend that only deeper institutional reforms or technological innovation can bring about a new economic cycle. They say that macroeconomic regulation and control measures such as fiscal and monetary policies usually do not trigger cyclical changes in the economy. What is your view on this? Are fiscal and monetary policy dynamics related to the cyclical nature of China's economy?

Qiu Xiaohua: The argument that China's economy is at the starting point of a new cycle has support from reform and innovation. First,it can be seen that since the 18th Communist Party Congress (in 2012) there has been a new political environment. This new environment has stressed rules,regulations and order. Second,there is more innovation and a greater opening up to the outside world as seen with the "Belt and Road" initiative,the internationalization of the renminbi and the construction of free trade areas. Third,there is a new wave of technological developments such as in artificial intelligence,Internet+,bioeconomics and other breakthrough areas.

In terms of macro-control policies,the policy orientation is also gradually being fine-tuned. This year's policy orientation has undergone a shift from moderately neutral to moderately tight and then to moderately neutral,reflecting the concerns of policymakers about the short-term economic fluctuations. There is less concern about short-term economic fluctuations,and more concern about how to resolve long-term risks in the economy,such as debt risk and financial risk. So from the policy fine-tuning we can sense a possible change in the economic cycle.

He Fan: If we cannot really obtain further reform dividends,there are no grounds to conclude we are on the cusp of a new economic cycle. Current monetary policy is "prudent," indicating that China wants to maintain its current trend,without resorting to a sudden tightening. Now many companies face difficulties in obtaining adequate financing. The tighter monetary policy will cause the economy to encounter greater downward pressure. However,monetary authorities have no intention of further relaxing monetary policy. "Neutral" is slightly more moderate than "prudent," and such changes in the wording of statements from monetary authorities suggest there is now more emphasis on stability. There is another meaning for "prudent" policies and that is the need for stability and the prevention of financial risks. Prudent policy suggests we need to be more vigilant about potential financial risks.

Zhong Wei: Regardless of whether there is a new economic cycle,there will be many internal and external risks and challenges ahead for the economy. What do you see as the coming economic trends? What kinds of policy support do we need in the future to stabilize the economy or make the new economic cycle more visible?

Qiu Xiaohua: In order to make the leap from a large economy to a real economic power,China needs to pay attention to a number of contradictions already encountered in the process of economic restructuring and upgrading. At the same time,it must face the challenges brought about by the uncertainties of the international situation. To maintain the steady development of the domestic economy,it needs to pay more attention to the following:

First,China needs to strengthen the three "respects;" that is,the respect for the laws of the market,respect for entrepreneurs and respect for talent. First,it must speed up the building of the market system,improve market mechanisms,eliminate market segmentation and break up industrial monopolies. Second,the central government needs to further implement policies regarding the protection of property rights. This needs to be brought under the legal system more effectively as soon as possible. At the same time there must be respect for the entrepreneurial spirit. Third,reform of the education system needs to be accelerated so that we can vigorously cultivate innovative talent. That needs to be accompanied by respect for knowledge and creativity,so that those who have knowledge and are creative can share in the benefits of these attributes.

Second,the government needs to implement the "three adherences," and by that I mean adhering in an unwavering manner to the principle of economic construction as the key objective while adhering to the goal of supply side structural reform and adhering to the principle of opening up the economy. In today's world,development is still the main objective. China cannot lag behind. It needs to guide people from all walks of life to work towards development. To this end,China must boost confidence in development and strengthen the national determination to work toward this goal. There should be agreement on the need for the upgrading of the industrial structure as well as corporate structure,ownership structure, urban and rural structures and income distribution. We need to effectively implement policies that speed comprehensive reform. To enhance the sense of urgency for reform,we need to provide a reliable institutional mechanism to protect structural adjustment and upgrading.

Third,there is a need to tap the "three potentials," and by that I mean tapping the potential of the domestic market,tapping investment potential and tapping the potential for more public goods and services. In terms of the domestic market,we need to vigorously develop health care and old age care. At the same time,we must meet the consumption needs of women and children and ensure the protection of the environment. There is also a need for developing financial services as the number of affluent and high-income individuals expands. In tapping the potential for public goods and services,there is a need for greater investment in national defense,foreign affairs,education,health care,culture,social security and housing. We must also make the supply available on a more equitable basis by eliminating discrimination and increasing the transparency in supplying these goods and services.

He Fan: China's economy is still at the bottom of an L-shaped trend. It is expected that the economy will be relatively stable in the second half of the year,but there will be some risks which have not become apparent yet. This year's economic growth pattern may turn out to have a good start but a lower finish. Downward pressure on the economy is likely to increase in the second half of the year,and this is mainly because the inventory building I mentioned earlier cannot last forever. If private enterprises do not step up their investment,then the pressure on economic growth will be relatively severe. New reform initiatives in the future are critical. Without further reform dividends,we may see fresh declines in investment and this in turn will affect economic growth.

Zhong Wei: Many people still have doubts about whether China's economy has really entered a new cycle. If we are in fact on the verge of this important change,we should be able to see the emergence of a new form of development characterized by innovation,coordination,green economy values,openness and sharing. Real estate and finance will no longer be the leading sectors. Raising debt and printing money will no longer be the mainstay of macroeconomic expansion. There are increasingly strong expectations from the public that China's economy may be on the verge of this new cycle. Hopes for new momentum in economic growth and for new reforms are mounting.